M&A MBA Pule Magau

description

Transcript of M&A MBA Pule Magau

REGENESYS MANAGEMENT

MERGERS AND ACQUISITIONS

BY PULE MAGAU

7/15/2013

ID NUMBER;

7607075281084

LEARNER NUMBER:

177289

COURSE CODE NUMBER;

4863MNA-(4863 – MBA)

PAGES:

(22)

Lecturer:

Riaan Steenberg

1

Contents Page

Introduction ................................................................................................................................ 2

1. The Acquisition of Massmart by Walmart ............................................................................ 3

1.1. Introduction .................................................................................................................. 3

1.2. Situational Analysis – Pre acquisition stage ................................................................. 4

1.2.1. Macro-environmental PEST Analysis .................................................................... 4

1.2.2. Industry Analysis ................................................................................................... 5

1.2.3. Market Analysis .................................................................................................... 6

1.3. A critical analysis of the three reasons of the acquisition of Massmart by Walmart ...... 7

1.4. The extent to which the reasons for the acquisition were effectively achieved ............. 8

2. The Three Problems Encountered By BMW In Its Acquisition Of Rover And How These Mistakes Could Have Been Avoided .........................................................................................10

2.1. Introduction .................................................................................................................10

2.2. Due Diligence .............................................................................................................11

2.3. Leadership ..................................................................................................................13

2.4. Conclusion ..................................................................................................................15

3. A Report On “The Proposed Merger Between Nedcor And Stanbic” As Developed By The Competition Commission For The South African Reserve Bank ................................................16

3.1. A critical evaluation of the strategic intent of the proposed merger between Nedcor and

Stanbic ..................................................................................................................................16

3.2. A critical evaluation of the positive and negative impact on the financial services sector

if the proposed merger between Nedcor and Stanbic were to be allowed ..............................18

3.3. A critical evaluation of the positive and negative impact on the financial services sector

if the proposed merger between Nedcor and Stanbic were to be allowed ..............................19

Conclusion ............................................................................................................................21

References ...............................................................................................................................22

2

INTRODUCTION

South Africa has witnessed a flow of merger and acquisition activity over the past few years, recent high profile mergers and acquisitions include Famous Brands purchase of the Bread Basket, Bidvest’s highly publicised interest in Adcock Ingram, and the approval of the merger between mining giants Glencore and Xstrata (abndigital, 2013). A report released by data provider mergermarket, produced in collaboration with Nedbank Capital and law firm Edward Nathan Sonnenberg revealed that International investor interest was increasing in Africa, with South Africa often being viewed as a vehicle to access other African markets (Kamhunga, 2012). The mergermarket report stated that on a country-by-country basis, South Africa took the lion’s share when it came mergers and acquisitions, accounting for half of the top 10 mergers and acquisitions deals on the African continent in recent times (Kamhunga, 2012). This report will examine the acquisition of the South African retailer Massmart by the American retail giant Walmart. A critical analysis will be undertaken in order to establish the three reasons for the acquisition, and then an assessment will be made to ascertain the extent to which these reasons were effectively achieved. The explanations in this analysis will be supported by relevant theories and literature. The second section of the report will review the case study of the takeover and merger that went badly wrong, the BMW and Rover merger and acquisition. According to the case study, BMW had committed three key mistakes in their takeover of Rover, these have been identified as the following; a lack of proper due diligence; clash of cultures; and poor leadership. A report will then be developed for the attention of BMW executive management to substantiate the reasons as to why the takeover was unsuccessful, a critical discussion will then be provided on ways in which BMW could have avoided the problems they had encountered in the takeover, with special emphasis being placed with regards to due diligence and leadership. The final section of the report, will study the report on “The Proposed Merger between Nedcor and Stanbic” as developed by the Competition Commission for the South African Reserve Bank. Based on the findings in this report from the Competition Commission, a critical evaluation will be made on the strategic intent of the proposed merger between Nedcor and Stanbic. A critical discussion will also be made on the advantages and disadvantages of the proposed merger. The final section will critically evaluate the impact, both positive and negative, on the financial services sector if the proposed merger between Nedcor and Stanbic were to be allowed.

3

1. THE ACQUISITION OF MASSMART BY WALMART

1.1. Introduction

In March 2012, the American multinational retail corporation Walmart successfully completed its acquisition of a 51 percent stake in the South African retailer Massmart for US$ 2.4 billion, in one of the largest merger and acquisition transactions that has ever been executed in Africa (Hathaway, 2013). This acquisition saw Walmart, one of the biggest retailers in the world enter into the African continent, this was unprecedented as most industrialised countries focused expansion into sectors such as natural resources in Africa. The acquisition of Massmart by Walmart not only saw it increase its presence in Africa but validated the recognition of Africa as an expanding consumer market and provided a further step for the continents growing economy (Hathaway, 2013). The acquisition process between Walmart and Massmart unfolded in 27 September 2010 when Massmart announced Walmart’s intention to acquire a 51 percent controlling interest into Massmart (Saflii, 2011). In terms of the proposed transaction Walmart would seek to acquire 51 percent of the ordinary share capital at 148 rand per Massmart share (dealbook.nytimes.com, 2010). On 31 May 2011, the Competition Tribunal (Tribunal) conditionally approved the merger between Walmart Stores, Inc (Walmart) and Massmart Holdings Limited (Massmart). The primary acquiring firm is Walmart Stores, Inc (Walmart). Walmart is a firm that is incorporated and listed on the New York Stock Exchange. Walmart is the largest retailer in the world consisting of three retail formats in the form of stores, that are stocked with a variety of general merchandise, supercenters offering a variety of bakery goods, meat and dairy products; fresh produce: dry goods and staples, beverages, deli-food; frozen food, canned and packaged goods as well as household appliances, apparel and general merchandise, internationally Walmart currently operates in 24 countries (Financial Mail, 2013), at the time of the acquisition announcement the firm was operating in 15 countries (Saflii, 2011). The primary target firm is Massmart Holdings (Massmart). Massmart is a company incorporated in South Africa under the company laws of the Republic of South Africa. Massmart is listed on the Johannesburg Stock Exchange (JSE). Massmart has over 10 subsidiaries nationwide and around the African continent (Saflii, 2011), including 51 stores in 11 countries (Financial Mail, 2013). Massmart is a wholesaler and retailer of grocery products, liquor and general merchandise (Saflii, 2011). Massmart consists of four divisions: Massdiscounters, Masswarehouse, Massbuild and Masscash. Massmarts food and grocery offering are aimed at the low-end customers predominantly at the wholesale level and through its Masscash division; it also plays a very active role in the retailing of grocery products (Saflii, 2011).

4

1.2. Situational Analysis – Pre acquisition stage

1.2.1. Macro-environmental PEST Analysis

Political

South Africa is country with a dynamic multiparty democracy with an independent judiciary and a liberal and diversified press (www.southafrica.info, 2013). South Africa’s highest law is the constitution which is seen as being one of the most progressive in the world. Following the successful hosting of the 2010 World Cup in South Africa, the local and global sentiment towards South Africa was very positive. These factors could have also reinforced Walmart belief that South Africa has a stable political and regulatory environment.

Economic

Despite the impact of the global world recession, the successful hosting of the World Cup provided a significant boost to the economy of South Africa with the country receiving tourists within a record breaking 8.1 million (southafrica.info, 2012). South Africa’s economy grew by 0.5 percent solely because of the World Cup tournament, and it has been projected to grow by a total of 3 percent over the 2010 period (globalpost.com, 2010). For the first time in history Africa has received more foreign direct investment than aid at $8 billion in 2008, with sub Saharan Africa being the third fastest growing region in the world, trailing China and India, due to factors such as its sound economic policies coupled with opportunities in infrastructure, transport, communications, energy, and the demand for consumer goods (globalpost.com, 2010). These factors have provided an impetus for Walmart to enter into the South African market.

Social

South Africa has a labour intensive sector with a supply chain that links across various sectors, tourism has been prioritised a by South Africa’s government since it is one of the six job drivers of the New Growth Path framework (southafrica.info, 2012). Walmart’s intent to acquire Massmart would also have be aligned to interventions such as the National Tourism Sector Strategy, that was to be launched in 2011 with its objective being to ensure that the tourism sector realises its full potential in terms of job creation, social inclusion, services exports and foreign exchange earnings, to foster an increased understanding between peoples and cultures, as well as green transformation (southafrica.info, 2012).

Technological

According to a 2010 report from Deloitte, South Africa technological progress has made it emerge as a competitive 21 century economy, South Africa has been likened to a mix of developed and developing world, its solid technological and economic base have placed it on par with well developed nations worldwide (southafrica.info, 2010). South Africa IT infrastructure has been criticised for needing improvements in order to be globally competitive, primarily through the provision of high quality networks and greater liberalisation of telecommunications (southafrica.info, 2009). According to Alastair de Wet, chairperson of South African chapter of the Business Software Alliance, South Africa has been identified as an emerging outsourcing destination along with Ukraine and Vietnam through the realisation of faster, more reliable and more secure internet access, South Africa can look forward to receiving a significant boost with fast, competition-led infrastructure development (southafrica.info, 2009). These factors make it a favourable country for Walmart to invest into, especially with the technological prowess and systems provided by Walmart.

5

1.2.2. Industry Analysis

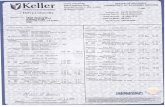

The retail industry in South Africa has experienced a growth in recent years; this growth has largely been fuelled by both the supply of retail space and the proliferation of shopping centres throughout the country, with major retailers such as Edcon, Pick n Pay, Shoprite, Woolworths, and Massmart leading the retail segment (treasury.gpg.gov.za, 2012). According to the Bureau of Market Research (BMR) the industry was in the region of R600 billion, of which on 30 percent represented food sales, most notably South Africa has been leading the drive into untapped markets in other African countries (brasilglobalnet.gov.br, 2011, p. 3). Over the past few years the industry has grown by an annual average 3 percent, the rise in shopping centre developments has also seen townships benefitting from this. Retail sales have shown a sharp increase over the years with an average annual increase of 29 percent in online retail sales, the total retail trade sales are expected to increase even further. Figure 1. Retail Industry Trade Sales growth Jan 2004 - Jan 2012

This unprecedented growth in the retail industry as illustrated in Figure 1 has been largely spurred by the favourable economic conditions that consumers have found themselves during this period, that include the level of the interest rate, inflation and economic growth. This stable economic environment has allowed consumers to spend more which has positively influenced the value of retail trade sales (treasury.gpg.gov.za, 2012). Gauteng has been the largest contributor at 26.5 percent share of gross value added by the retail industry, this contribution the industry has made has been of great value to the economy and the public as it has offered employment opportunities, especially to the youth (treasury.gpg.gov.za, 2012). The retail industry in South Africa has however suffered its share of challenges such as increasing operational costs and skills shortages, however the relatively developed infrastructure and institutions that South Africa offers has made it an attractive destination for multinational companies that also view the country as being investor friendly (treasury.gpg.gov.za, 2012). A noteworthy development in the South African retail industry is the accelerated growth in online shopping, this is defined as the form of electronic trade whereby consumers utilise the internet to purchase products that they require, which are then delivered to their doorsteps. According to a 2011 Online retail study conducted by World Wide Worx online retail in South Africa has been growing at a consistent rate, with the total amount spent on online retail goods in the country increasing from R470 million in 2004 to above R2billion in 2010, this was an average annual increase of 29 percent, by 2011 online retail had totalled R2.6 billion a 30 percent increase from 2010 (treasury.gpg.gov.za, 2012). This increase of online retailing is assisted by the continuous increase in the number of experienced internet users.

6

1.2.3. Market Analysis

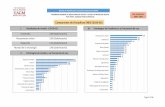

According to Statistics South Africa, retail food, beverage and toiletry sales achieved a growth rate of 51 percent in sales from 2005 to 2009 (brasilglobalnet.gov.br, 2011). General dealers accounted for 70 percent of retail sales, whilst specialist outlets accounted for 17 percent, and pharmacy, cosmetic, and toiletry retailers accounted for the remaining 13 percent (brasilglobalnet.gov.br, 2011). Furthermore according to AC Nielsen, 70 percent of all retail sales are done through retail stores, which include the major supermarkets, branded forecourt stores and franchises. The remaining 30 percent of goods are marketed by the more than 80,000 independents and spaza outlets (brasilglobalnet.gov.br, 2011). The major retail chains in the industry have the advantage of enormous purchasing power as they are able to dictate buying terms to suppliers who are generally required to deliver products to central depots or warehouses, where the products are distributed to supermarkets and retail outlet stores nationally (brasilglobalnet.gov.br, 2011). Figure 2 below illustrates the composition of the retail market by the type of retailer for the 2011 period.

Figure 2: Composition of retail market in South Africa

It is evident from this Figure 1 that the industry is dominated by general dealers, which contributed to the bulk of total retail trade sales. This can be exemplified by the dominance of non-specialised stores with food, beverages and tobacco such as the mass gross retailers mentioned as the key industry players. Specialist retailers also include the retailers in the textiles, clothing, footwear and leather goods comprise the second largest share at 17 percent. The remainder of the retailers contribute 13 percent to total retail trade sales.

70 % General Dealers

17 % Specialist outlets

13 % Pharmacy, cosmetic,toiletry

7

1.3. A critical analysis of the three reasons of the acquisition of Massmart by Walmart

There are various prominent theories that explain the motives behind mergers and acquisitions, these broad theories consist of the following; the efficiency theory, the monopoly theory, raider theory, valuation theory/investment theory, empire building theory/agency theory, the process theory and the disturbance theory (Regenesys Management, 2013, p. 16). The efficiency theory describes M&A as being planned and executed to achieve synergies of three types: financial, operational and managerial, whereby the motive is net gains through synergy. Monopoly theory is planned and executed to achieve market power. Horizontal and conglomerate M&A allow firms to cross subsidise products, limit competition in more than one market simultaneously, and deter potential entrants from the markets, all with the intended aim in creating a higher market power, whereby the motive is wealth transfer from customers (Regenesys Management, 2013, p. 16). The raider theory is defined a person who causes wealth transfers from shareholders of companies he or she bids for in the form of greenmail or excessive compensation after a successful takeover, whereby the motive is wealth transfers from targets shareholders (Regenesys Management, 2013, p. 16). In a valuation theory the M&A is planned and executed by managers who possess better information about the targets value than the stock market, under an empire building theory the M&A is planned and executed by managers who thereby maximise their own utility instead of shareholders value, whereby the motives are net gains through private information (Regenesys Management, 2013). The similarities behind all these described theories is that M&A is seen as a rational choice, the motive behind the empire building theory/agency is that M&A benefits managers (Regenesys Management, 2013). The process theory states that decisions are outcomes of processes governed by various influences such as organisational characteristics and culture (Regenesys Management, 2013, p. 16), Disturbance theory states M&A waves are caused by economic disturbances that are can effect changes in individual expectations and increase in the general level of uncertainty, in this instance M&A is seen as a macroeconomic phenomenon (Regenesys Management, 2013, p. 16). The three most significant reasons of the acquisition of Massmart by Walmart include the fact that Walmart sought to enter emerging markets, specifically those such as South Africa and sub-Saharan Africa, that account for approximately 20% of the consumer spending of the African continent as a whole (Saflii, 2011), Walmart seeks to enter into the African continent which offers greater growth prospects than its already saturated markets in developed countries through South Africa which it believes is the gateway into the African continent because of its sophisticated and stable economy, as well as political and regulatory environment (Saflii, 2011), this and the fact that a quarter of international retailers interviewed cited that Africa will present the new retail growth story of the decade, this underlines the motive to exploit the first mover advantage according to 33 percent of the recipients (business.iafrica.com, 2013). This reasoning implies that the monopoly theory was exercised as the ultimate goal of entering the African continent was to achieve market power, in this instance market power can achieved through Walmart entering the different countries on the African continent and developing a strong market presence, thereby limiting competition, and deterring potential entrants from the markets, all of which will assist to achieve higher market power. Walmart and Massmart also compete in a similar industry, therefore Walmart’s acquisition of Massmart is a horizontal acquisition, where Walmart can expand its product range and increase its revenue by selling more products to already existing clients of Massmart, whilst allowing both the firms to cross-subsidise their products. In applying the monopoly theory Walmart can maximise Massmarts established customer base in its 51 stores across 11 countries, so as to improve the distribution

8

coverage of its own products. Walmart’s acquisition of Massmart will effectively increase Walmart’s market share and decrease its competition The second reason for the acquisition is the strategically aligned goal of expansion that both firms sought to achieve. Walmart’s strategy is focused heavily on international expansion, this strategy fits in line with Massmarts goal of expanding its operations in South Africa and further across the African continent (Saflii, 2011). Massmart is of the view that due to Walmart’s collective skills and capabilities, this will allow the merged entity to implement its pre-merger expansion plans with greater confidence on an expedited basis, enabling it to exploit the skills, systems and processes that have already been developed, implemented and tested by Walmart (Saflii, 2011). This reason is supported by the monopoly theory and efficiency, because an expansion strategy will aim to achieve market power through increasing market share, and an efficiency theory because Massmart as expressed the desire to adopt the skills, systems and processes that Walmart has already developed.

The third reason for the acquisition is that Massmart anticipates that Walmart will be able to provide new skills and technologies to assist Massmart in becoming a significant distributor of locally produced, perishable products, thereby complementing and supporting Massmarts aim of expanding its fresh grocery operations (Saflii, 2011), whilst at the same time Walmart will increase its ability to source quality affordable produce locally (Hathaway, 2013). This implies that Massmart would like to achieve economies of scope. Massmart has shifted its focus towards food sales, which it aims to double in the ensuing five years (Saflii, 2011). Expansions such as these will provide new opportunities for agricultural smallholdings to participate in Walmart’s global supply chain. These findings indicate that the efficiency theory warrants critical considerations in Walmart’s acquisition of Massmart as it has been explained that Walmart will be able to provide new skills and technologies to drive Massmart’s ambitions to be a significant distributor of local produce, whilst Walmart will also secure a local source for locally produced supply, this arrangement suggests a synergistic relationship, one where net gains are achieved from a combination of financial and operational synergies. The advantage of this relationship is the effect it will have of benefitting the economy, local businesses and consumers overall.

1.4. The extent to which the reasons for the acquisition were effectively achieved

The reason of the acquisition of Massmart by Walmart as a means to enter into the rest of the African continent and fulfil its growth objectives has been achieved. According to Grant Pattison the CEO of Massmart, addressing the annual general meeting of the firm, he informed shareholders that new stores have been opened in South Africa and other neighbouring countries during the first 21 weeks of 2013. Pattison was quoted as saying “We have had new stores openings in Makro in Alberton, Gauteng, Builders Warehouse in George, Western Cape and Saverite in Xia Xia, Mozambique” (www.fastmoving.co.za, 2013). Pattison further indicated that over the remainder of the financial year to December Massmart will be opening 27 stores, including Makro in Amanzimtoti, Durban, and a Builders Warehouse store in each Botswana and Mozambique (www.fastmoving.co.za, 2013), however Massmart experienced a fall in sales growth for the first 21 weeks of the financial year that has negatively impacted all product categories and across South African geographies (www.fastmoving.co.za, 2013). Massmart has experienced a 5,6% increase in same store sales during the first 21 weeks of the fiscal year 2013, a drop in comparison to the 7.35% growth in the second half of 2012

9

(www.supermarket.co.za, 2013), however the expansion into the African continent will offset the slower growth in its domestic market.

The second reason of expansion has been well achieved, considering that Walmart and Massmart aimed to extract as much synergistic value as possible. This has been achieved partly because Walmart has been able to reduce its capital outlay in expansion drive as Walmart CE Mike Duke emphasised they had sought to add 36 mft-40 mft during the 2013 financial year in comparison to the 34,6 mft they added in 2012 (Financial Mail, 2013). In addition to this Walmart lifted its earnings-per-share (EPS) by 10, 6% and its dividend by 18% (Financial Mail, 2013). Its free cash flow profit available for dividends and expansion also rose 185 to $12,7billion (Financial Mail, 2013), increased cash flows are the result of one of their first goals, creating market power. According to Barclays Capital analyst Robert Drbul, Walmart’s EPS foresees EPS growth of 9% in 2013 to January 2014, with an increase of 9.4% in the following year, Drbul also forecast dividends to grow at a similar pace. Walmart’s dividend yield is now 2.5% (Financial Mail, 2013) indicating slow but positive growth for the firm. This view is also endorsed by Peter Armitage of Anchor Capital that asserts “Walmart’s underlying business is very robust and seems set to deliver at least 10% earnings growth each year for some time to come” (Financial Mail, 2013). Pattison has admitted that the slow rate of growth has also been partly due to the high initial start-up costs and initial operating inefficiencies incurred by the merger and acquisition. Pattison has however noted that Massmart is reliably holding or gaining market share in most categories at the group level, although in some circumstances may be swapping market share between Massmart brands” (West, 2013). These facts suggest that the merger has created an increased market share for both parties, achieving their initial objectives.

The third reason of the acquisition has been adequately addressed, Massmart anticipated that the acquisition will provide Massmart with Walmart’s skills and expertise, an economies of scope as highlighted previously; this objective has been partly achieved through International Produce Limited (IPL) which Walmart controls. IPL purchases fresh produce in South Africa for the export market none of which are sold back to the South African market (Saflii, 2011). This has provided Massmart with a ready export market for its fresh fruit produce which Massmart has placed a big strategic emphasis on. IPL has also been responsible for providing practical advice to local suppliers in relation to quality standards as well as communicating product information and shipping arrangements to the ASDA.

10

2. THE THREE PROBLEMS ENCOUNTERED BY BMW IN ITS ACQUISITION OF

ROVER AND HOW THESE MISTAKES COULD HAVE BEEN AVOIDED

RE: BMW Executive Management Report on BMW/Rover takeover

2.1. Introduction

In 1994, BMW acquired Rover for £800m, this could have been construed as a positive move at the time because BMW was interested in increasing its volumes and perhaps there were only a few purchases available at the time. Asides from this, BMW needed an iconic brand similar to those such as MINI and Land Rover so as to not dilute the carefully natured image of the BMW brand and the newly named Rover for what was previously British Leyland (BL), a business with prestigious catalogue of names such as Morris, Austin, Austin Healey, Wolseley, Riley, Land Rover and MG seemed an ideal fit for BMW at the time, especially as it was interested in pursuing 4WD vehicles which it did not manufacture at the time. ROVER had been formed through a series of mergers aimed at creating a group large enough to be able to compete in the world car market (Whiteley, 2012).

In hindsight however, and after a critical analysis of the takeover from various reports it is evident that BMW made three critical errors. The first mistake is with regards to lack of due diligence; it has been documented that BMW concluded the deal in only 10 days (Whiteley, 2012). This indicates that BMW did not look closely enough at the operation of the business within ROVER, a closer investigation would have revealed BMW that as early as 1985, the Thatcher Government had been in talks about selling BL’s car business to Ford and the truck & car business to General Motors which neither deal incidentally got off the ground, this raised enough eyebrows to prompt questions which would have been the starting point of a proper due diligence, subsequently BL was sold to British Aerospace (BAe), and re-christened Rover forming a partnership with Honda. At the period prior to the sale to BMW it is worth noting that BAe was itself in financial difficulties in 1991 which speculatively could have prompted the eventual offloading of Rover, which by that time had many deficiencies which were already forced through in order to cut costs (Whiteley, 2012).

The second mistake was a clash of cultures, as mentioned before Rover had formed a partnership with Honda, in this partnership that lasted from 1979 to 1988. Honda had assisted Rover by introducing lean production techniques to provide a basis for new models. A problem however arose between the two firms as Rover did not really have a “learning culture”, in fact there were strong trade unions that resisted improvements to efficiency as this was seen to contribute to job losses (Whiteley, 2012). Rover essentially had a “not invented here attitude” that was cynical of other approaches to manufacturing (Whiteley, 2012). The third problem was that of poor leadership, it has been established that BMW was split over whether Rover should have been acquired and subsequently more directors resigned in the one year after the acquisition than in the previous forty (Whiteley, 2012), this can be attributed to the inability of the CEO, Berndt Pietschrieder who led the board and management throughout the merger. Due to the lack of support and commitment from some of the BMW executives, Rover never received the investment required to develop a ‘BMW 2 series’ equivalent to replace its aging 200 series. This report will seek to critically discuss the ways in which BMW could have avoided these problems.

11

2.2. Due Diligence

According to Evans, “Due diligence is a very detailed and extensive evaluation of the proposed merger” (as cited in Regenesys Management, 2013,p. 70). Evans goes on further to say that the question that should be answered during the due diligence process is “will this merger work”, the way that this can be answered is to determine the kind of possible “fit” that exists between two companies merging (as cited in Regenesys Management, 2013, p. 70). According to Evans this process of finding the best fit will involve pertinent questions that address the following criteria; the investment fit, this asks what sort of financial resources will be required and what level of risk fits with the new organisation; the strategic fit, will examine what management strengths are brought together through this M&A, both parties must provide something unique to the table to create synergies. The marketing fit, which asks how will products and services complement one another between the two companies, such as their promotion programmes, brand names, distribution channels, and customer mix, etc. In the case of the BMW acquisition of Rover it is evident that both brands brought with them considerable pedigree, BMW was very impressed with the quality that Rover brought to the table, and in some instances perceived Rover to be better in terms of quality (Button, 2013), this is very important as BMW’s perceived brand image shouldn’t be tainted by an association with weaker brand so a marketing fit did exist. This was a potentially solid strategic fit as both firms pursued the premium segment of the market with BMW having access to Rovers heritage that it could exploit with makes such as MG, Riley, Austin-Healey, Triumph, furthermore BMW was investigating developing a 4WD vehicle and Rover could ideally provide knowledge with their Land Rover 4WD technology (Button, 2013). BMW could have used its existing dealership networks to sell the Rover products, such as it has done with the MINI brand (Button, 2013). Ultimately though BMW wouldn’t be able to market its 4WD vehicle side by side with Rovers Land Rover product as they are too similarly positioned in the market, the BMW and MINI relationship is successful today because both brands complement each other, because whilst MINI is still a premium brand it is positioned directly below BMW, and doesn’t have any products that compete with BMW directly (Button, 2013). A thorough due diligence would have uncovered this. The operating fit, asks the question how well do the different business units and production facilities fit together, such as the labour force, technologies, production capabilities, etc (Regenesys Management, 2013, p. 70). Due diligence would have established that the both the firms have different cultures, with regards to the labour force and production capabilities. BMW is very progressive and open to innovation (Button, 2013), whereas Rover was mired by a labour force that resists a learning culture as mentioned earlier, this would have already brought about an undesirable operational fit. Management fit, seeks to ask what expertise and talents do both companies bring to the merger and how well do these elements blend together. Financial fit, seeks to ask how well do financial elements fit together, such as sales, profitability, return on capital, cash flow, etc (Regenesys Management, 2013, p. 70). Evans states that due diligence goes far beyond the boundaries of the functional areas of a company such as finance, production, and human resources, and that the main purpose of due diligence is risk identification (Regenesys Management, 2013, p. 71). Due diligence needs to identify all the risks involved in the potential M&A that crosses beyond the everyday dealings of the company, such as issues relating to the market, including questions such as what is the size of the target market, major threats, and how this can be improved (Regenesys Management, 2013, p. 71). Identifying of the customer, who they are, and creating a complimenting connection between the business and the target customers. Identifying the competition that the target company brings, and recognising the barriers to competition in that market. The legal

12

risks should also be identified, in order to establish what liabilities, lawsuits, and other claims are outstanding against the target company (Regenesys Management, 2013, p. 71). BMW did not undertake an adequate risk identification as they completed the deal in only 10 days, and due diligence is required to be extremely extensive because management is relying on the synergy values in order for the transaction to be a success (Regenesys Management, 2013, p. 71). The amount of synergy needs to confirmed as well in reality, as the total value of synergies assists management in determining the actual amount to be paid for the M&A, a proper due diligence would have discovered that there were less synergies than what the management had expected. I would advise that BMW should have spent adequate time to uncover the risks mentioned previously. A due diligence would have identified the many deficiencies that were forced through to Rover by BAe in order to cut costs resulting in a sub-standard investment. The poor sales that Rover achieved under BMW could be also attributed to the compromised production facilities and tools that Rover delivered which BMW inherited through the acquisition which included Rover’s Longbridge manufacturing plant (Button, 2013). A due diligence by BMW would have identified misrepresentations in the financial statements of BAe, thus revealing probable low quality assets in the balance sheet that would have been manipulated in achieving the final over inflated sale price of £800 million. It was mentioned that BAe itself was in financial troubles in 1991, since mergers are often aimed at cutting cost, due diligence might result in upwardly inclined adjustments to earnings for the target company (Regenesys Management, 2013, p. 74). BMW should have closely examined the income statements as represented by BAe, paying closer attention to the actual “cash’ earnings as opposed to “accrual” type earnings that could be potentially misleading. According to Evans due diligence also includes the cultural and human resource aspect, when two different entities are combined, their policies, and procedures as well as people and cultures are combined (Regenesys Management, 2013, p. 74). Due diligence is required to set the foundation for the post-merger integration phase (Regenesys Management, 2013), the main aim of a cultural due diligence is to identify possible issues that might be critical to integration and assist management to plan accordingly for the necessary actions in order to resolve differences that might arise before the merger has been announced (Regenesys Management, 2013, p. 74). In order to avoid some of the problems that arose such as the cultural clash, BMW should have conducted a culture audit of Rover in the initial stages before it made a decision to announce the acquisition, a cultural audit is the process of determining the culture type of the merged or acquired company, differences in values, beliefs, norms, practices and procedures are identified during this audit (Regenesys Management, 2013, p. 32). It was mentioned previously that Rover had a non-existent learning culture; they were sceptical of other approaches to manufacturing. BMW utilises the most cutting edge production techniques (Button, 2013), but these attempts to integrate them were thwarted by Rover and hence the cultural clash, Rover’s culture was also influenced by the strong trade union background that resisted improvements to efficiency as this was seen to cause job losses. A closer look into Rover’s culture would have revealed this problem sooner, and plans could have been put in place to counter this threat.

13

2.3. Leadership

There are various reasons why a merger or acquisition may succeed or fail, one of the key considerations is an incomplete understanding and implementation of the merger and acquisition process, at the heart of this issue lays leadership. In order to mitigate failures and lay a foundation for success, managers need to be armed with certain tools, tactics and techniques to guide them in achieving a successful merger and acquisition. According to the Watson Wyatt Deal Flow Model introduced by Galpin and Herndon, there are five stages to be followed in a typical M&A transaction, there are three representative models, including Picot’s three stage model of planning, implementation and integration, however the Watson Wyatt Deal Flow Model is generally seemed to capture the most comprehensive picture of how the M&A process is organised (Regenesys Management, 2013, p. 24). Of particular importance is that the Watson Wyatt model takes into account the pre-acquisition analysis of strategic fit and organisational fit mentioned earlier. According to the Watson Wyatt model the merger and acquisition process should begin with the first stage “formulate” this part is vital because it sets the stage for the business strategy as well as the growth strategy, providing a more strategic insight into the M&A deal (Regenesys Management, 2013, p. 24). The next stage is “locate” which seeks to identify target markets and companies, where a decision would then be undertaken to select the target, issue letters of intent and letters of confidentiality to then begin the strategy and integration development process (Regenesys Management, 2013). The next stage would be the investigate stage which would consist of the due diligence analysis, a summary of the findings, and an articulation of the integration plan, this would be concluded by planning, assessing and forecasting the value. These aforementioned stages all belong to the pre deal phase. The latter part of the M&A process would include the negotiate stage, that would entail setting the deal terms, covering the legal, structural, and financial aspects. This would be followed by the securing of key talent and integration teams which would escalate to closing the deal, and agreeing on the value of the deal. The final stage entails finalising and executing the plan, taking into account the organisations, process, people, and systems; this would lead to the post-deal stage of realising the value of the deal (Regenesys Management, 2013, p. 25). It is necessary to highlight that BMW conducted a poor investigate stage as they failed to undertake a due diligence of Rover as demonstrated by the 10 day deal completion period, the negotiate stage was also not properly adhered to, as more considerations could have been placed on the veracity of Rovers financial statements given the exorbitant price BMW paid for this sale. The BMW and Rover merger demonstrated poor leadership that warranted an unprecedented amount of directors to resign in a year due to a split over whether Rover should have been acquired, citing a lack of commitment from some of the BMW executives. Bernd Pietschreider, the BMW CEO should have adopted the Watson Wyatt model from the initial stage that BMW expressed interest in approaching Rover. Because merger and acquisition processes are viewed by most companies as being decision making activities, Bernd Pietschreider should have approached this decision making activity very carefully and strategically. Sudarsanam describes the M&A as a decision making process reflecting four potentially debilitating inter related factors, these include a fragmented perspective on the acquisition held by a different manager, escalating momentum in decision making, ambiguous expectations of different managers about the benefits of the acquisition and diversity of motive amongst managers in lending support to the acquisition (Regenesys Management, 2013, p. 26). These inter related factors reveal how crucial leadership is in directing the process and communicating with all the involved stakeholders. Bernd Pietschreider should have engaged the BMW board from the

14

onset during the formulate stage, which in this transaction was abandoned all together considering the 10 day period it took to close. This would have provided an opportunity to garner executive support at the pre-deal assessing and planning stage, allowing it to be easier to avoid the pitfalls that Sudarsanam expressed in the decision making process. DiGeorgio is however a bit more specific, when he classifies the success of M&A into two stages (Regenesys Management, 2013, p. 30). The first stage is called front-end success. The result of front end success is the selection of the right target for the M&A. This stage consists of many elements such as the characteristics of leadership, a facilitating climate within the stakeholder team; adequate time and resources and tools for M&A analysis; possessing learning mechanisms; and understanding culture and organisational structure differences entailed in the analysis (Regenesys Management, 2013, p. 30). In the BMW and Rover deal, applying these principles of the front-end success would have avoided the problems experienced by BMW, the result of a success in this area would have culminated in selecting a right target for BMW. The first part requires a characteristic of leadership, the BMW board need to have confidence in the leadership, and the leader needs to achieve a buy-in from the board which will create a facilitating climate within the stakeholder team. The leadership also needs to ensure there are adequate time and resources and tools for M&A analysis, the 10 day turnaround time taken by BMW clearly indicates this was not achieved as it was too brief. BMW should have also developed learning mechanisms, to understand the Rover culture and organisational structure differences entailed from the culture audit and analysis discussed previously. This stage would have assisted BMW in identifying if there is a cultural fit, and what measures could be put in place to resolve this, such as the issue of the Rover non-learning culture. The second stage is integration success, the successful outcome of the second stage is to achieve the objectives, which necessitates selecting the right leadership, structuring the integration team, and a developing a detailed plan in terms of communication, integration and people issues (Regenesys Management, 2013, p. 30). Berndt Pietschrieder failure to lead his board and management through the merger was also attributed to poor integration success. The defining moment in the integration success stage is selecting the right leadership and correctly structuring the integration team. Emphasis should have been placed at this stage on assembling the leadership that would ultimately be responsible for the success of the entire M&A, as they would be tasked with developing the detailed planning, which would entail the communication plan, integration plan, and people plans. The importance of having the leadership being a part of the integration process is that there is an ownership aspect attached to it, the executive and management will be more committed to the process if they are involved from the start. It is also necessary for the leadership to communicate the new company vision to teams from both sides of the transaction, so as to motivate people to channel their energies in the direction required to achieve the objectives of the integration. The level of the integration success will determine post-merger integration, whereby all processes of the merged entities will be blended and seamless, including the management of human resources, technical operations, and customer relationships.

15

2.4. Conclusion

The BMW Rover merger is an example of what can go wrong in a takeover and merger if there are no adequate processes put into place, The BMW acquisition of Rover demonstrates that a lack of proper planning and processes can result in an unrealised positive synergy balance, which is the main aim of merger and acquisition to begin with. BMW made numerous mistakes, such as initiating a lack of proper due diligence, and demonstrating poor leadership in the transaction, which invariably exposed other problems that surfaced such as a clash of cultures between the two entities. In the first part of the report relevant theory and principles are explored to justify the importance of due diligence, and how BMW could have avoided many of the problems they encountered if they had taken time and pursued a proper due diligence of Rover, this would have helped to identify what type of “fit” existed, if any. It was explained that management is relying on balanced synergy values in order to achieve a successful merger and acquisition, failing which to achieve a deal should be declined or rejected altogether. There are however a few types of fits that were identified between the two entities such as their marketing fit, and a potential strategic fit that wasn’t carefully investigated and explored. BMW was seeking to develop 4WD vehicles and they could have fast tracked that development with knowledge extracted from the Land Rover platform, and Rover was seeking to develop a 2 series equivalent based on BMW technology, these were a few areas that could have provided good synergies, however Rover never received the investment it required to replace its aging 200 series, which challenged the scrutiny BMW had applied in its financial due diligence of Rover especially citing reference that BAe which owned Rover was itself in financial difficulties in 1991 and many deficiencies had been forced through in order to cut costs.

The second part addressed the issue of alleged poor leadership as portrayed by BMW, citing the exodus of directors from BMW in the one year after the acquisition, and the general lack of commitment from the board and management. It was established that leadership is a crucial element of a successful acquisition and that the leader is the driver of merger and acquisition process, under which there are three representative models of merger and acquisitions with the Watson Wyatt model deemed the most comprehensive portrait of how the M&A process is organised. In interrogating the reasons for the problems BMW experienced in the M&A, a study of the Watson Wyatt Deal Flow model and its five stages revealed that BMW had skipped some of the critical stages of a necessary M&A process, such taking into account the pre-acquisition analysis of a strategic fit and organisational fit defined in the formulate, locate and investigate stage. A study of DiGeorgio’s M&A was more specific and revealed probable causes for the problems experienced with particular regards to leadership, and explanations were provided as to how BMW could have avoided these problems based on the principles that the model outlined. It was observed that a critical aspect of creating a practical leadership was adhering to the instructions of the first stage in the front end success; this required that BMW had to instil a certain characteristic of leadership, and a facilitating climate within the stakeholder team to encourage support and activism towards the newly combined entity. A cultural audit would have also assisted BMW in understanding the target company and adjusting learning mechanisms accordingly. Communication was a critical element that was missing when BMW acquired Rover, there was no management support or buy-in, as Berndt Pietschreider didn’t lead his board and management through the merger but somehow seemed to unilaterally impose the decision on the BMW board. The suggested approach was to involve the right leadership, and engage with them as they would be the drivers that would ultimately be responsible for the integration success. The integration team would develop the detailed planning in terms of communication, integration, and people issues ultimately ensuring a successful M&A.

16

3. A REPORT ON “THE PROPOSED MERGER BETWEEN NEDCOR AND STANBIC”

AS DEVELOPED BY THE COMPETITION COMMISSION FOR THE SOUTH

AFRICAN RESERVE BANK

3.1. A critical evaluation of the strategic intent of the proposed merger between Nedcor and Stanbic

The proposed hostile takeover of Standard Bank Investment Corporation (“Stanbic”) by Nedcor Limited (“Nedcor”) was reviewed and evaluated by the Competition Commission in compliance with the provisions of Section 37(2) of the Banks Act, 1990. Due to the limited experience with regards to evaluating the competition effects of bank mergers in a South African context, the competition commission has reviewed international approaches to competition analyses of bank mergers. Based on that approach the commission has adopted to identify the distinct services provided by the banking industry through identifying the following three distinct categories; Corporate, Investment and Merchant Banking Services; Retail Banking Services: Personal customers; Retail Banking Services: Small businesses (compcom.co.za, 2000). These categories are then broken down to the different products within these categories (compcom.co.za, 2000, p. 10). The following observations were made with regards the pre-merger competitive situation throughout the different markets in the Corporate, Investment and Merchant Banking category. It was established that Stanbic has the largest share of the cash, cheque and transmission account market (compcom.co.za, 2000, p. 21). The average market share of the next three big players in this market is 21 %. Stanbic thus have on average a 9% larger market share than its closest competitors (compcom.co.za, 2000, p. 21). Of all the four big players in the market for demand deposits all have a market share of close to 20%, with no player having a market share advantage of more than 3% over its closest competitor (compcom.co.za, 2000, p. 21). Stanbic and Nedcor are the two biggest players in the treasury services market. It was also established

that Stanbic has a clear market share advantage over all their other competitors in the following markets; International banking services (19%), International business centers (20%), Custodial services (18 %) (compcom.co.za, 2000, p. 21). Nedcor has the largest share of the market for cash, cheque and transmission accounts at 33.8 % in the Personal Retail Banking category (compcom.co.za, 2000, p. 31). The other three big players in this market have on average a market share of 21 %. Nedcor has a market share advantage of 10 % over its closest competitor (compcom.co.za, 2000, p. 31). In the Personal Retail Banking category the following was likely to occur; Post-merger the merged entity will have a market share that exceeds 50 % and a substantial market share advantage of between 28 % and 32 % in two of the markets (compcom.co.za, 2000, p. 31). It is evident from the above that the merger will lead to substantial market share advantages for the merged entity in at least four of the markets in Personal Retail Banking (compcom.co.za, 2000, p. 31). In addition, the merged bank will clearly have a significant market share, in excess of 38% in all of those product markets (compcom.co.za, 2000, p. 31). Based on the market analysis provided above it is evident that Nedcor and Stanbic would certainly benefit from an increased market share and a dominant share in Retail Banking and Corporate and Merchant Banking categories.

17

It is evident from the above that the merger will lead to substantial market share advantages (more than 30 %) for the merged entity in at least five (5) of the markets in the Corporate, Investment and Merchant Banking (compcom.co.za, 2000, p. 22). This synergy can be drawn from the fact that Stanbic is ranked at the top in corporate and merchant bank space. This indicates that Nedcor and Stanbic could also intend to merge as a way of achieving growth

quickly as the post-merger market shares of the merged entity and the levels of concentration in the majority of the markets in this category indicate that the merged entity will have superior market power in at least eight of the twelve markets identified (compcom.co.za, 2000, p. 25). The larger merged entity will therefore have better access to capital markets, which would drive the costs of capital downwards through efficiencies, resulting in improved financial benefits. Nedcore and Stanbic will also seek to achieve economies of scale, and achieve a potential cost saving, which is in line with the norms of international bank mergers (compcom.co.za, 2000, p. 17). The three areas of potential cost

saving have been identified as follows; Greater scale economies or rationalisation in banking operations. This can be achieved through a consolidation of payment services, deposit inquiries and loan-monitoring operations (compcom.co.za, 2000, p. 17). Nedcor and Stanbic will also strategically seek to achieve economies of scope, which can be achieved through adding a new range banking products to existing business (compcom.co.za, 2000, p. 17). The newly merged entity will also have a stronger capital structure as well as a reduced risk profile; the efficiencies achieved as a result of economies of scope will eliminate duplicated costs, thereby having a positive impact in creating stronger free cashflows, which would also expedite the development of IT systems (Marcus, 2001) In South Africa IT is seen to be a major strategic competitive factor, since this forms part of the basis for South African Banks push to improve cost efficiencies (Marcus, 2001). Nedcor and Stanbic are regarded to be the only two true competitors in the market with regards to their product innovation, with Stanbic leading the way in terms of its contributions to technologies in retail banking (compcom.co.za, 2000, pp. 38-39). Along with Stanbic, Nedcor, Absa and First National Bank of South Africa are the largest local custodian banks in South Africa (Kentouris, 2000). Through Nedcor acquiring Stanbic, this would ensure Nedcor's dominance in the local custody arena and in nearby markets in the sub-Saharan region that Stanbic services (Kentouris, 2000). This has the potential of creating a regional bank with the sizable scale and efficiency to complete on an international scale against international banks, the benefit of this would be increased trade across South Africa, whilst simultaneously contributing to the enhancement of African banking as well as the development of the South African Development community (Marcus, 2001).

Ultimately though, the merged entity seeks to achieve market power because this can potentially create barriers of entry for new entrants. According to Martin “Oligopoly models predict that market power increases with increasing market concentration and with the difficulty of entering a market.”(as cited in compcom.co.za, 2000, p. 40). This is particularly true in the case of retail banking South Africa, which has very high barriers of entry. The effect of this has been a few participants sustaining position of market power without attracting any new entrants (compcom.co.za, 2000, p. 40). It is further maintained that market power usually arises when market share is approximately 15 %. At higher market shares, such as 25 to 30 %, the degree of monopoly power may become quite significant, and market shares over 40 to 50 % usually give strong market power (compcom.co.za, 2000, p. 17).

18

3.2. A critical evaluation of the positive and negative impact on the financial services sector if the proposed merger between Nedcor and Stanbic were to be allowed

According to Nedcor and Stanbic, there are a number of potential efficiency, technology and other pro-competitive gains that would be realised from the merger. Nedcor has submitted to the competition commission that a number of technology and efficiency gains would be gained as a result of the proposed transaction, of those a reference is made to economies of scale and economies of scope (compcom.co.za, 2000, p. 49). Nedcor has argued that some of the

advantages resulting from the economies of scale in the transaction would be the elimination of duplicate spending on technology as the two merged entities would rely on the same systems architecture; Increased purchasing power when dealing with international providers (such as Microsoft); Technical gains from adoption of the same smart card standard, as well as efficiencies from increased scale for both smart cards and cell banking; And scale advantages, which would facilitate increasing the functionality of existing applications. In addition to the above the proposed merger would further provide other efficiencies resulting from the consolidation and rationalization of 260 bank branches in areas where there is currently duplication of branches; The transfer of 670 ATMs from areas of duplication to currently un-served areas (compcom.co.za, 2000, p. 49); and The rationalisation and consolidation of the processing infrastructure, which would result in a reduction of transactions costs by 28% (compcom.co.za, 2000, p. 50). According to Nedcor, these efficiency and technology gains would result in a merged entity with a cost-to income ratio of 48% and a return on equity (ROE) of 30% (compcom.co.za, 2000, p. 50). The current cost-to-income ratios of Nedcor and Stanbic are levelling at 54% and 61% respectively. The anticipated ROE of 30%, it is argued, would result in a merged bank that is internationally competitive, which is encouraged by Christo Wiese, the South African registrar of banks was quoted as saying South Africa has to consider the international trend of banking mergers if South Africa wants to remain competitive (Kentouris, 2000). Furthermore, Nedcor also claims that the merged entity would set the efficiency standard for the industry as a whole, which would ultimately result in lower prices and benefits for consumers (compcom.co.za, 2000, p. 50).

In addition another significant advantage of the proposed merger between Nedcor and Stanbic is the economies of scale will also positively influence the merged entity in terms of incurred

investment capability, which can be explained to mean the entity’s trading ability through borrowing against the merged bank’s asset base (compcom.co.za, 2000, p. 50), this essentially implies that the larger asset base resulting from the proposed merger allows the bank to borrow a larger amount of funds for investment (compcom.co.za, 2000, p. 50). One of the benefits in economies of scale and technology is the elimination of duplicate spending on technology, it is anticipated that the fixed cost per customer of implementing smart cards will fall as the number of customers increases (compcom.co.za, 2000, p. 51). However, it is possible the fixed cost of implementing this technology is presumably a once-off cost. This may imply that total costs decline.

19

There are also foreseeable disadvantages associated with the proposed merger, for instance Nedcor has indicated that the cost reductions and other efficiencies initiated will result in a higher return on equity (ROE), however on the flip side the price structures will remain

approximately at the pre-merger level, even though cost will decline. This is to the extent that some of Stanbic’s current pricing such as bank charges is below that of Nedcor, this may even indicate that some prices will increase after the merger (compcom.co.za, 2000, p. 52). This price increase will affect consumers negatively especially as there haven’t been any claims by Nedcor that this would be avoided. It has been asserted by the competition commission that the only way that cost structures will decline is through a price war between the competition, so unless the cost savings are transferred to customers through lower prices the likelihood is very low that price competition from the merged bank will result in lower cost structures across the industry as a whole (compcom.co.za, 2000, p. 53). Another disadvantage of the proposed merger is that no in-depth efficiency analysis has been conducted by either party that would have assisted in clarifying whether the merged entity would result in actual improvements, such as the possibility of bringing the Stanbic portion of the consolidated entity up to par with the efficiency levels of Nedcor (compcom.co.za, 2000, p. 53). There are also the certain considerations to take into account such as the difficulties in managing a larger bank, and the problems of integrating the two data processing systems could prove to be costly and time consuming (compcom.co.za, 2000, p. 53). A case in point of problems in integrating IT systems has been evidenced by previous mergers, with a report by Deloitte & Touche concluding that most mergers have fallen far of the expectations promised, such as BNP/Paribas that had underperformed its peers by 26% since its merger announcement (Marcus, 2001). It has been cited that part of the reason why implementation risks were so high was because there was no experience of such large-scale integration, especially with regards to IT systems, that have been reported to take up to six years (Marcus, 2001). There are also the potential problems that can arise from mergers such as different managerial and corporate cultures that will have to be integrated.

3.3. A critical evaluation of the positive and negative impact on the financial services sector if the proposed merger between Nedcor and Stanbic were to be allowed

In order to assess the impact that the proposed merger would have on the financial services sector the competition commission consulted with representative trade unions, namely South African Society of Banking Officials (SASBO) in respect of the primary acquiring firm and IPSA in respect of the primary target firm (compcom.co.za, 2000, p. 54). SASBO represents approximately 65% of the Bargaining Unit of Stanbic (17,000 employees) and approximately 30% of the Bargaining Unit of Nedcor (5,500 employees). IPSA represents approximately 36% of the Bargaining Unit of Nedcor (6,500 employees). IPSA does not represent any Stanbic employees (compcom.co.za, 2000, p. 54). According to SASBO the biggest negative impact that would affect the banking sector from the proposed merger would be related to the permanent loss of employment opportunities (compcom.co.za, 2000). IPSA confirmed that to their knowledge, the proposed transaction would result in the direct loss of approximately 4,800 jobs in the banking sector (compcom.co.za, 2000, p. 55) . In addition to this SASBO further asserted that the proposed merger would also have serious effects on customers, highlighting that an estimated 20% of all branches would be

20

closed (compcom.co.za, 2000, p. 55). Negative sentiments were also felt among Standard Bank employees who were strongly not in favour of the transaction; likewise Nedcor employees also voiced their opposition to the proposed merger. According to IPSA it was expected that 10,800 jobs would be lost. What was equally distressing to IPSA is that Stanbic planned to shed about 3000 jobs and that Nedcor would be shedding 2,000 jobs, should the merger not take place (compcom.co.za, 2000, p. 54). Nedcor has asserted that the proposed merger would enable the merged bank to climb the international rankings, and increase the profile of South African banks internationally which would have a positive impact on the local banking sector as it would increase the global profile of South African banks (Marcus, 2001), however other empirical research seems to suggest that bigger was not always better and that in the United States between 1988 to 1997 the 10 largest banks had a lower than average return on assets (Marcus, 2001). They further argued that the South African domestic banking was already concentrated, due to the four large banks dominating the retail, small business and large corporate markets. Furthermore comparable mergers would not be allowed in countries such as Australia and Canada as they argued that the merger would vastly increase systematic risk and concentration (Marcus, 2001). On the positive side, Nedcor had made assurances to IPSA that retrenchments would only be a last resort and that Nedcor would rely on natural attrition in order to reach their staffing goals (compcom.co.za, 2000, p. 54). IPSA also highlighted that the average turnover of staff in the banking sector is between 12-13% per annum. It was discovered that the natural staff attrition of the two banks would therefore be 18,000 employees over a three-year period (compcom.co.za, 2000, pp. 54-55). IPSA positively concluded that as a result of the merger 8,000 new employees would be hired over the three-year period (compcom.co.za, 2000, p. 55). Past experience from the Nedbank-Perm merger revealed that in the short term, a takeover may result in job losses, but over the long term it would actually result in increased employment on the condition that the merged entity was efficient (compcom.co.za, 2000, p. 55). It was proven that in Nedbank Perm case, Nedcor initially reduced the number of jobs from 16,000 to 15,000 (compcom.co.za, 2000, p. 55). Nedcor currently employs 18,000, a net increase in employment opportunities of 2,000 (compcom.co.za, 2000, p. 55). Furthermore as Nedcor is currently the most efficient of the South African retail banks in terms of cost to income ratios, IPSA considered it likely that Nedcor would continue to grow as an institution, thus creating further employment opportunities in the long term (compcom.co.za, 2000, p. 55). A big positive impact would be achieved for the banking sector as a whole if the proposed merger were to happen as the newly merged bank would be catapulted up in the international rankings which Nedcor argues will allow the bank to compete on the international market and to be able to be globally competitive (compcom.co.za, 2000, p. 56).

21

Conclusion

In the first section of this report we studied the acquisition of the South African retailer Massmart by the American giant retailer Walmart. After a thorough evaluation it was discovered that the three main reasons that Walmart had acquired Massmart was that Walmart sought to enter the emerging markets particularly Africa, with South Africa providing the most suitable avenue of entering Sub Saharan Africa and the rest of the African continent. The second reason for the acquisition was that both Walmart and Massmart had similar aspirations of expansions in their long-term strategic plans, the third reason for the acquisition was that Massmart had anticipated that Walmart would be able to provide new skills and technologies to assist Massmart in becoming a major distributor of locally produced, perishable products in South Africa and abroad. Based on the findings of the recent performances of Walmart-Massmart, and the overriding sentiment towards the Walmart-Massmart merger and acquisition, it was concluded that the reasons for the acquisition were effectively achieved. The second section of this report analysed the unfruitful merger and acquisition between BMW and Rover, in this analysis it was observed that BMW had committed three critical mistakes that involved a lack of proper due diligence; clash of cultures; and poor leadership. A report was drafted to BMW executive management in response to the three mistakes highlighted in the case study, detailing the processes BMW could have taken in order to avert the problems that had persisted from the BMW and Rover merger and acquisition. Relevant theories and principles were applied in the steps that BMW should have taken to avoid those problems.

The final section of the report was with regards to the proposed merger between Nedcor and Stanbic. This extensive report provided insights into how the Competition Commission viewed the proposed merger between Nedcor and Stanbic, and provided their inputs as to how they viewed the merger, expressing how they believed it would benefit and would be of detriment to the banking sector, consumers of banking products, and the industry as a whole. Using the Competition Commissions report as a frame of reference, a critical evaluation was undertaken on the strategic intent of the proposed merger between Nedcor and Stanbic, a critical discussion was also made on the advantages and disadvantages of the proposed merger between Nedcor and Stanbic. Lastly, a critical evaluation was concluded on the impact, both positive and negative, that the proposed merger would have on the financial services sector

22

REFERENCES

abndigital. (2013, July 1). Mergers and Acquisitions in SA. Retrieved July 5, 2013, from www.abndigital.com: http://www.abndigital.com/page/multimedia/video/power-lunch/1582398-Mergers-and-Acquisitions-in-SA

brasilglobalnet.gov.br. (2011, February 1). Overview of the south african retail trade . Retrieved July 1, 2013, from brasilglobalnet.gov.br: http://www.brasilglobalnet.gov.br/arquivos/publicacoes/estudos/retailtradereport.pdf

business.iafrica.com. (2013, April 16). iafrica.com business business news Retailers scramble for Africa. Retrieved July 10, 2013, from business.iafrica.com: http://business.iafrica.com/news/851384.html

Button, L. (2013, July 1). BMW takeoverof rover. Retrieved July 10, 2013, from site.plummo.com: http://site.plummo.com/category.php?licenseKey=37e6d44add3dfcb44ac279ea80185e7e&ID=1778

compcom.co.za. (2000, April 14). The proposed merger between nedcor and stanbic. Retrieved July 10, 2013, from www.compcom.co.za: http://www.compcom.co.za/

dealbook.nytimes.com. (2010, November 29). Wal-mart Formalizes $2.4 Billion Massmart Bid - NYTimes.com. Retrieved July 9, 2013, from dealbook.nytimes.com: http://dealbook.nytimes.com/2010/11/29/wal-mart-formalizes-2-4-billion-massmart-bid/

Financial Mail. (2013, April 18). In different aisles - FM. Retrieved July 10, 2013, from www.fm.co.za: http://www.fm.co.za/business/money/2013/04/18/in-different-aisles

globalpost.com. (2010, September 28). South Africa World Cup 2010 Economy GlobalPost. Retrieved July 10, 2013, from www.globalpost.com: http://www.globalpost.com/dispatch/africa/100927/africa-world-cup-2010-investment-clinton-foundation

Hathaway, L. (2013, March 4). Walmart-Massmart commercialises the local supply chain: A step in the right direction? Retrieved July 6, 2013, from www.consultancyafrica.com: http://www.consultancyafrica.com/index.php?option=com_content&view=article&id=1244:walmart-massmart-commercialises-the-local-supply-chain-a-step-in-the-right-direction-&catid=82:african-industry-a-business&Itemid=266

Kamhunga, S. (2012, December 4). Half of Africa's top 10 merger and acquisition deals this year target SA. Retrieved July 12, 2013, from www.bdlive.co.za: http://www.bdlive.co.za/business/2012/12/04/half-of-africas-top-10-merger-and-acquisition-deals-this-year-target-sa

Kentouris, C. (2000, April 17). Custody Battle in South Africa: Nedcor's Bid for Standard Bank Hits Legal Wrangle. Retrieved July 11, 2013, from www.securitiestechnologymonitor.com: http://www.securitiestechnologymonitor.com/issues/20000416/11499-1.html

Marcus, G. (2001, Jan 1). an approach to the consideration of bank merger issues by regulators: a south african case. Retrieved July 10, 2013, from www.bis.org: http://www.bis.org/publ/bppdf/bispap04o.pdf

Regenesys Management. (2013). Mergers and Acquisitions. In Mergers and Acquisitions. Sandton: Regenesys Management.

Saflii. (2011, June 29). Walmart Stores Inc v Massmart Holdings Ltd (73/LM/Dec10) [2011] ZACT 42 (29 June 2011). Retrieved July 9, 2013, from www.saflii.org.za: http://www.saflii.org/za/cases/ZACT/2011/42.html

23

southafrica.info. (2009, July 10). How the world rates South Africa. Retrieved July 10, 2013, from www.southafrica.info: http://www.southafrica.info/business/economy/policies/ratesa08.htm

southafrica.info. (2010, June 18). World Cup 'turning point' for South Africa. Retrieved July 10, 2013, from www.southafrica.info: http://www.southafrica.info/2010/turningpoint-180610.htm

southafrica.info. (2012, December 7). South Africa's tourism industry. Retrieved July 10, 2013, from www.southafrica.info: http://www.southafrica.info/business/economy/sectors/tourism-overview.htm

treasury.gpg.gov.za. (2012, June 1). the retail industry on the rise in South Africa. Retrieved July 1, 2013, from treasury.gpg.gov.za: http://www.treasury.gpg.gov.za/Document/Documents/QB1%20The%20Retail%20Industry%20on%20the%20Rise.pdf

West, E. (2013, May 22). iafrica.com business world news Massmart sales up 9.8 percent. Retrieved July 10, 2013, from business.iafrica.com: http://business.iafrica.com/worldnews/860675.html

Whiteley, S. (2012, May 10). Takeovers and Mergers - one that went badly wrong (BMW and ROVER). Retrieved July 7, 2013, from www.tutor2u.net: http://www.tutor2u.net/blog/index.php/business-studies/comments/buss4-mergers-acquisiitons-one-that-went-wrong.-bmw-and-rover

www.fastmoving.co.za. (2013, May 30). Massmart to focus on store growth in Africa - FMCG Supplier News. Retrieved July 12, 2013, from www.fastmoving.co.za: http://www.fastmoving.co.za/news/supplier-news-17/massmart-to-focus-on-store-growth-in-africa-3802

www.southafrica.info. (2013, July 10). South Africa: fast facts - SouthAfrica.info. Retrieved July 10, 2013, from www.southafrica.info: http://www.southafrica.info/about/facts.htm

www.supermarket.co.za. (2013, May 24). Mass Chain Warns Of Slower Growth In Year Ahead. Retrieved July 9, 2013, from www.supermarket.co.za: http://www.supermarket.co.za/news_articles.asp?ID=4160